Unknown Facts About Palau Chamber Of Commerce

Table of ContentsThe Only Guide to Palau Chamber Of CommerceThe Palau Chamber Of Commerce PDFsWhat Does Palau Chamber Of Commerce Do?5 Simple Techniques For Palau Chamber Of CommerceThe smart Trick of Palau Chamber Of Commerce That Nobody is Talking AboutThe 2-Minute Rule for Palau Chamber Of CommerceWhat Does Palau Chamber Of Commerce Do?Some Ideas on Palau Chamber Of Commerce You Should KnowPalau Chamber Of Commerce Can Be Fun For Everyone

In an attempt to offer info to individuals preferring to begin a charitable organization in Maryland, the Philanthropic Organizations Department of the Workplace of the Assistant of State has gathered info set forth below on the necessary steps to form a non-profit company. While every effort has actually been made to make sure the accuracy of the information, please be recommended that specific questions as well as details ought to be directed to the appropriate firm.

The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

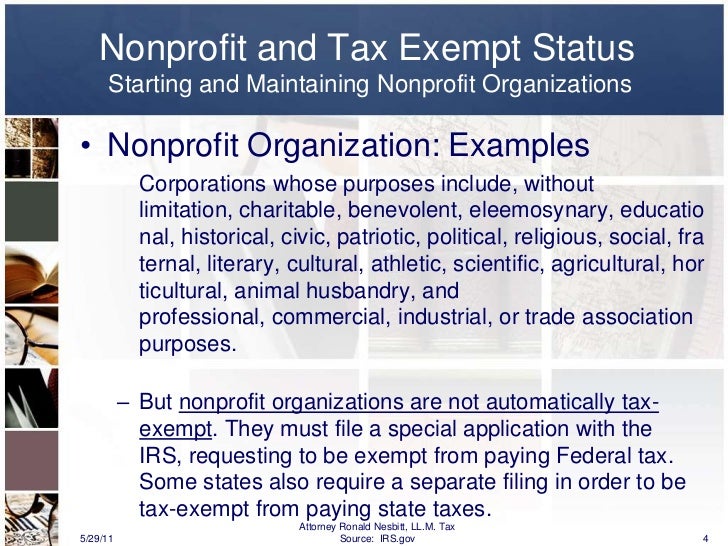

Before the Irs can issue your company tax-exempt status, your company should be formed as either an association, corporation, or trust. A copy of the organizing document (i. e., short articles of unification accepted and also dated by ideal state authorities, constitution or posts of organization, or authorized and also dated trust instrument) need to be filed with the IRS's Application for Acknowledgment of Exception.

To help non-profit companies, the firm has actually prepared a guideline for short articles of incorporation for non-profit organizations which can be gotten by contacting the firm. The firm's address is 301 West Preston Road, Baltimore MD 21201, as well as its telephone number is 410-767-1340. Kinds and information can be obtained from the firm's website.

Palau Chamber Of Commerce Fundamentals Explained

State law, nonetheless, grants the State Division of Assessments and also Tax the authority to perform periodic testimonials of the provided exceptions to ensure ongoing compliance with the requirements. While the tax-exempt standing provided by the internal revenue service is needed to process the exception application, the condition approved by the IRS does not instantly guarantee that the company's residential property will be exempt.

To obtain an exemption application kind or details regarding the exception, please get in touch with the State Division of Assessments and Tax workplace for the area in which the residential or commercial property is located. You might locate a list of SDAT neighborhood offices, additional info, as well as copies of the required types on SDAT's website.

All About Palau Chamber Of Commerce

Because method, they additionally benefit their areas. Particular sorts of organizations that are also classified as social ventures have the choice of click site registering their businesses either as a routine service or as a nonprofit company. The organization's objective may be the best indication of how best to sign up business.

It's usual for individuals to describe a nonprofit business as a 501(c)( 3 ); however, 501(c)( 3) refers to a section of the internal revenue service code that explains the requirements needed for organizations view publisher site to qualify as tax-exempt. Organizations that certify for 501(c)( 3) condition are required to run specifically for the function they specify to the internal revenue service.

Not known Factual Statements About Palau Chamber Of Commerce

Any kind of cash that nonprofits receive need to be recycled back into the company to fund its programs as well as procedures. Benefactors that make contributions to corporations that fall under the 501(c)( 3) code might subtract their contributions at the yearly tax obligation filing date. One of the most remarkable differences between for-profit and also not-for-profit entities is just how they acquire resources to run their services.

There Are Three Main Types of Charitable Organizations The IRS designates eight groups of organizations that might be permitted to run as 501(c)( 3) entities., consisting of public charities, exclusive foundations and also personal operating structures.

7 Simple Techniques For Palau Chamber Of Commerce

Contributors for private structures may donate approximately 30% of their earnings without paying taxes on it. Exclusive Operating Structures The least common of the 3 primary sorts of 501(c)( 3) firms is the exclusive operating structure. They resemble private structures, but they likewise supply energetic programs, just like a public charity.

They are regulated rather like exclusive structures. Both private structures and also exclusive operating structures aren't as greatly scrutinized as other philanthropic foundations because donors have close ties to the charity. There are 5 other kinds of 501(c)( 3) companies that have details functions for their organizations, consisting of: Scientific Literary Testing for public safety To promote national or worldwide amateur sporting activities competitions Prevention of ruthlessness to youngsters or pets Organizations in these categories are greatly regulated as well as kept track of by the internal revenue service for conformity, particularly relative to the donations they use for political campaigning for.

The Ultimate Guide To Palau Chamber Of Commerce

Nonprofit organizations are prohibited from giving away straight to any political candidate's project fund. In addition, not-for-profit companies can't campaign proactively for any kind of political prospects.

Board Supervisors and also Participants of Nonprofits Must Follow by All Rule Board directors and others gotten in touch with nonprofit companies have to know all legislations that they run into when functioning in or with a nonprofit company. Benefactors can mark just how they want nonprofits to use their funds, which are called limited funds.

Palau Chamber Of Commerce - Truths

This section contains analytical tables, short articles, as well as various other info on charities my company as well as other tax-exempt companies. Not-for-profit philanthropic companies are excluded under Area 501(c)( 3) of the Internal Income Code.

The Best Guide To Palau Chamber Of Commerce